Calculate salary per hour after tax

Your average tax rate is 165 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate. After spending about hour working out what my txt rate would be with my student loan etc I.

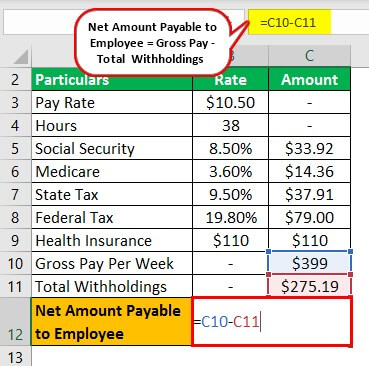

Salary Formula Calculate Salary Calculator Excel Template

Based on the 2018 wage bracket for a single-filer with zero claims the federal income tax each week is 63.

. If you earn 15 per hour and work 40 hours per week your weekly gross salary is 600. Multiplying this amount by 52 shows an annual gross income of 31200. The China Income Tax Calculator is designed for Tax Resident Individuals who wish to calculate their salary and income tax deductions for the 2022 Assessment year The year ending 31 December 2021.

For example if youre paid 15 per hour and work 40 hours per week your weekly gross pay is 600. Aside from the high earning city slickers there are plenty of Australians who get by on the national minimum wage of 2033 per hour. Multiplying this figure by 52 yields a gross annual income of 31200.

If you make 55000 a year living in the region of Florida USA you will be taxed 9076That means that your net pay will be 45925 per year or 3827 per month. This equates to a weekly salary of 77260 for a 38-hour work week. Your average tax rate is 212 and your marginal tax rate is 396This marginal tax rate means that your immediate additional income will be taxed at this rate.

Calculate federal income tax. What is a 56k after tax. Your average tax rate is 314 and your marginal tax rate is 384.

4409932 net salary is 5600000 gross salary. If you make 40000 a year living in Finland you will be taxed 15680That means that your net pay will be 24320 per year or 2027 per month. Just enter your gross annual salary into the box and click Calculate - then well present you with an overview of your tax and net salary.

Continue reading to find out more about the minimum wage for Australia. For instance an increase of 100 in your salary will be taxed 3843 hence your net pay will only increase by 6157. 30000 After Tax.

5Take home over 500mth. 40000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. What is a 40k after tax.

I was trying to find out my net pay after tax for 7000000. Earn 100 switching bank. This means that after tax you will take home 2017 every month or 465 per week 9300 per day and your hourly rate will be 1443 if youre working 40 hoursweek.

485 x 00765 3710 so the FICA tax to be withheld from the employees gross pay is 3710. Check your tax code - you may be owed 1000s. This marginal tax rate means that your immediate additional income will be taxed at this rate.

4Up to 2000yr free per child to help with childcare costs. Free tax code calculator. If your salary is 30000 then after tax and national insurance you will be left with 24204.

Finally dividing by 12 yields a. Each and every single cent could be tracked. This marginal tax rate means that your immediate additional income will be taxed at this rate.

If you make 300000 kr a year living in the region of Aabenraa Denmark you will be taxed 103464 krThat means that your net pay will be 196536 kr per year or 16378 kr per month. Calculate state income tax. Finally dividing by 12.

However the calculator will display net salary after income tax deduction. Your average tax rate is 392 and your marginal tax rate is 494This marginal tax rate means that your immediate additional income will be taxed at this rate. 56000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations.

If you make 55000 a year living in the region of California USA you will be taxed 11676That means that your net pay will be 43324 per year or 3610 per month. 2Transfer unused allowance to your spouse. 3202469 net salary is 4000000 gross salary.

Your average tax rate is 270 and your marginal tax rate is 353. Your average tax rate is 345 and your marginal tax rate is 407This marginal tax rate means that your immediate additional income will be taxed at this rate. For instance an increase of 100 in your salary will be taxed 3525 hence your net pay will only increase by 6475.

China 2022 Tax Calculators China 2022 Salary Examples China Tax Guides. 3Reduce tax if you wearwore a uniform. Scroll down to see more details about your 30000.

This article is based on Calculation Salary.

Hourly To Salary Calculator Convert Your Wages Indeed Com

4 Ways To Calculate Annual Salary Wikihow

4 Ways To Calculate Annual Salary Wikihow

Gross Income Formula Step By Step Calculations

How To Calculate Net Pay Step By Step Example

4 Ways To Calculate Annual Salary Wikihow

Annual Income Calculator

4 Ways To Calculate Annual Salary Wikihow

Hourly To Salary Calculator

4 Ways To Calculate Annual Salary Wikihow

Salary Formula Calculate Salary Calculator Excel Template

Annual Income Calculator

Salary Formula Calculate Salary Calculator Excel Template

3 Ways To Calculate Your Hourly Rate Wikihow

Payroll Formula Step By Step Calculation With Examples

Hourly To Salary What Is My Annual Income

Salary Formula Calculate Salary Calculator Excel Template